The AB = CD is a pattern based on Fibonacci retracements between only two legs. The AB=CD pattern has significantly fewer conditions but is another powerful price reversal indicator.

Bullish AB = CD

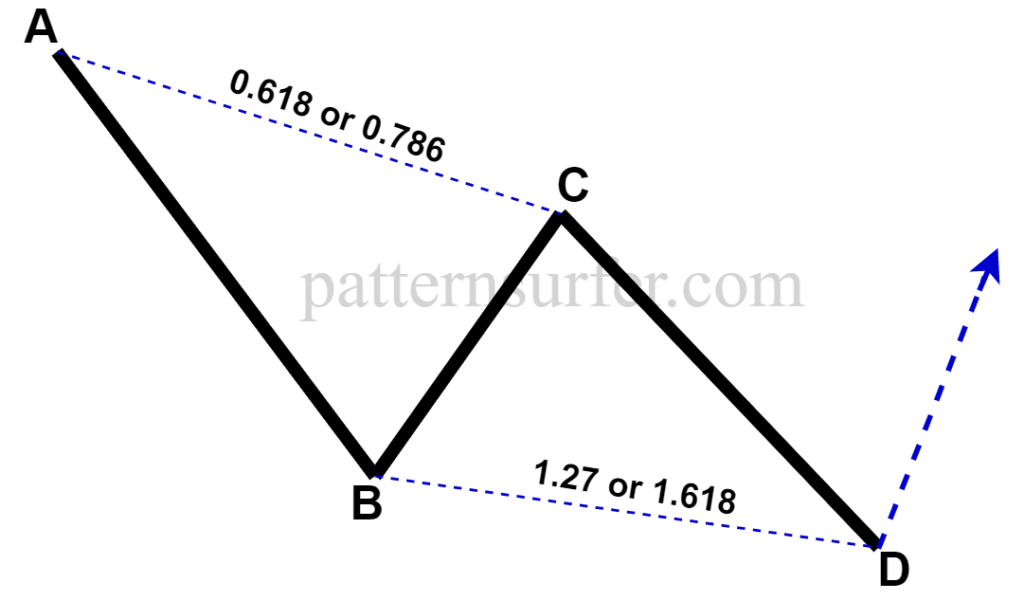

The Bullish configuration between the two legs follows one of two ratio sequences:

- Move CD is below move AB

- BC is a 0.618 retracement of AB, and CD is a 1.27 retracement of BC, or

- BC is a 0.786 retracement of AB, and CD is a 1.618 retracement of CD

Bearish AB = CD

The bearish configuration looks for the opposite configuration to identify a potential reversal to a sell scenario.

- Move CD is above move AB

- BC is a 0.618 retracement of AB, and CD is a 1.27 retracement of BC, or

- BC is a 0.786 retracement of AB, and CD is a 1.618 retracement of BC

AB = CD Pattern Identification with PatternSurfer

As patterns with only two legs, the AB = CD and its sister patterns the variations of Alt-ABCD, are simple methods given to investors and traders about potential price movement reversals.

They are especially useful as tools for profit-booking rather than full scale market reversal predictions, as they are considerably less complex than the rest of the Harmonic Patterns family.

For more information on how to trade the AB = CD pattern , see the PatternSurfer blog.