Belonging to the Geometric and Trendline pattern family, the Wolfe Wave does see some similarity -but is not strictly a part of – the Harmonic pattern family. The definitions of Wolfe Wave patterns are similar to many members of the Harmonic patterns as it is based on the relation of the price legs to each other. However they do not follow any Fibonacci retracement criteria.

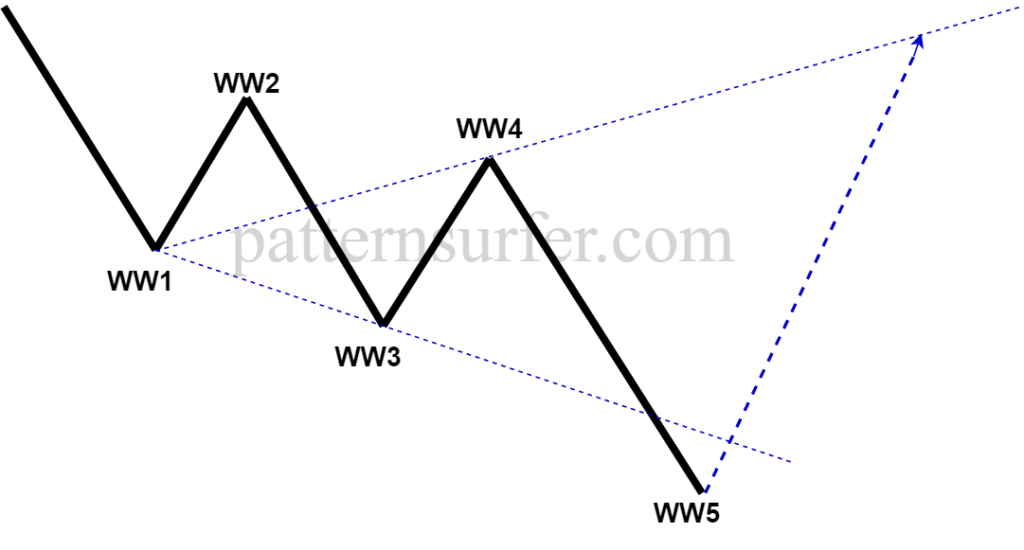

Bullish Wolfe Waves

The condition for a Bullish Wolfe Wave set up is defined below. The completion of WW5 is the final co-ordinate of the pattern. The Wolfe Wave is considered completed once the price re-enters the trendline formed by WW1 and WW3. This is the entry for a Bullish position.

- WW1, WW3 and WW5 are successive bottoms (each lower than the last)

- WW3 is less than WW1

- WW5 is less than WW3

- WW2 and WW4 are successive tops

- WW4 is less than WW2

- WW4 is above WW1

- WW5 breaks below or equals the trendline formed by WW1 and WW3, and re-enters.

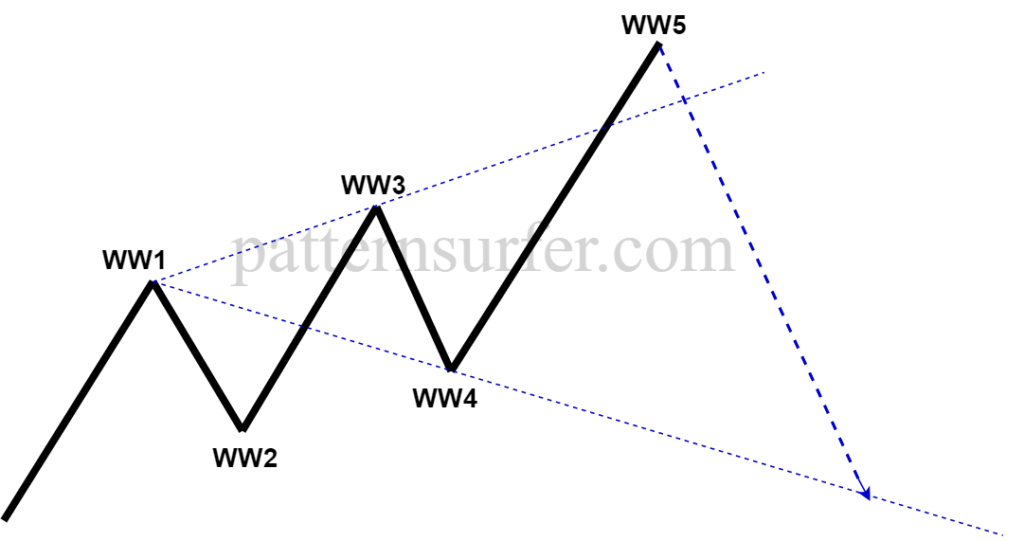

Bearish Wolfe Wave

The opposite conditions set up a Bearish Wolfe Wave, defined below. The completion of WW5 is the final co-ordinate of the pattern. The Wolfe Wave is considered completed once the price re-enters the trendline formed by WW1 and WW3. This is the potential entry for a Bearish position.

- WW1, WW3 and WW5 are successive tops (each higher than the last)

- WW3 is greater than WW1

- WW5 is greater than WW3

- WW2 and WW4 are successive tops

- WW4 is greater than WW2

- WW4 is below WW1

- WW5 breaks above or equals the trendline formed by WW1 and WW3, and re-enters.

Wolfe Wave Pattern Identification with PatternSurfer

For new traders of harmonic and geometric patterns, PatternSurfer suggests incorporating Wolfe Waves as a core pattern in your first trading strategy. Easy to master, the inherent high risk-reward payoffs make the Wolfe Wave pattern apt for beginners in technical analysis too.

In PatternSurfer, the Wolfe Wave will be identified after the formation of WW5, and after the price has reentered through the trendline as shown in the figures above. The pattern can be traded at this point, with WW5 as a conservative stop loss, varying upon the trader’s risk appetite.

You can find out more about how to trade Wolfe Wave Patterns, and more, in our documentation.