The Alt-ABCD is a variation on the traditional AB = CD, but does not look for the two legs of the pattern to be equal.

Bullish Alt-ABCD

There are two possible levels to the Bullish Alt- ABCD pattern:

- CD having a retracement of 1.27 below B,

- CD having a retracement of 1.618 below B.

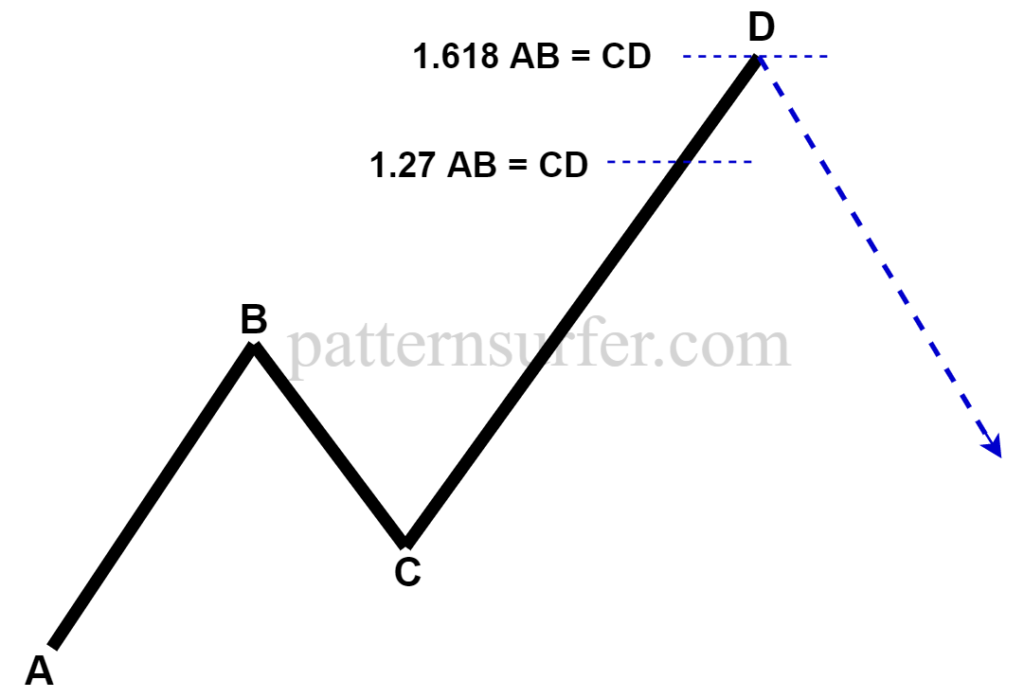

Bearish Alt-ABCD

A bearish Alt-ABCD follows the same retracement levels in the opposite direction. At the formation of D, which can be at two possible levels, a potential reversal for the price to fall can be expected.

- CD having a retracement of 1.27 above B,

- CD having a retracement of 1.618 above B.

Alt-ABCD Pattern Recognition with PatternSurfer

As patterns with only two legs, variations of Alt-ABCD as well as the originating pattern AB = CD, are simple methods which give information to investors and traders about potential price movement reversals.

The ABCD and Alt-ABCD are especially useful as tools for profit-booking rather than full scale market reversal predictions, as they are considerably less complex than the rest of the Harmonic Patterns family.

For more information on how to trade the Alt – ABCD and AB= CD patterns , see the PatternSurfer blog.